QUANT TRADING TECHNOLOGY

Explore Our Automated Algorithmic Trading Bots

Automated Algorithmic Trading

Enhance your trading efficiency - Minimise manual effort - Reduce emotional trading stress

Enhance your trading efficiency and reduce emotional trading with our Trading Applications.

AUTOMATION

Efficiency Through Automation. Let the trading bot do the work.

RISK MANAGEMENT

Stop-loss and drawdown limits for full control.

FOREX FOCUSED

Optimised for forex trading, focusing on strategy, not speed.

EMOTION-FREE TRADING

No more emotional trading - let predefined logic handle execution.

At Quant Trading Technology, we are dedicated to enhancing the trading experience exclusively for professional investors and traders. Our innovative automated trading solutions are designed to empower you to trade with greater efficiency and confidence. Our proprietary trading bots utilise advanced algorithms that execute well-defined strategies tailored to the unique dynamics of the market.

By leveraging cutting-edge technology, we enable you to focus on your trading goals while our expert team continuously monitors, maintains, and updates our bots to ensure they operate at peak performance. With our solutions, you can navigate the complexities of the financial markets with clarity and precision.

Our applications, designed for professional investors & traders, utilise advanced algorithms that execute well-defined strategies tailored to the dynamics of the gold and forex markets. To ensure full performance we continuously monitor, maintain, and update the applications.

QUANT TRADING TECHNOLOGY

Benefits & Advantages

Key Advantages

Automation

Streamline Your Trading Process

In today’s fast-paced trading environment, time is of the essence. Our automated trading bots execute trades based on predefined strategies, allowing you to concentrate on refining your overall investment approach.

This automation not only saves you valuable time but also enhances your ability to respond to market changes swiftly.

While our bots handle the execution of trades, we encourage you to remain actively engaged with your investments, ensuring that you maintain control over your financial journey.

Automation

Streamline Your Trading Process

Our automated trading bots execute trades based on predefined strategies and enhance you to respond to market changes swiftly.

While your bot handles the execution of trades, we encourage you to remain actively engaged and maintain control over your trading.

Risk Management

Safeguard Your Capital with Advanced Features

Risk Management

Safeguard Your Capital

Effective risk management is crucial in trading, and our bots are equipped with robust tools designed to help you manage risks effectively.

Features such as stop-loss orders and drawdown limits are integrated into our systems to assist you in protecting your capital.

While these features are designed to assist in risk management, it’s important to remember that trading involves inherent risks, and no tool can eliminate the possibility of loss. We believe in empowering our clients with the knowledge and tools necessary to make informed decisions, ensuring that you can trade with confidence.

Effective risk management is crucial in trading, and our bots are equipped with stop-loss orders and drawdown limits to assist you in protecting your capital. Nevertheless trading involves inherent risks, and no tool can eliminate the possibility of loss.

Forex Focused

Strategically Optimised for Forex Trading Opportunities

Forex Focused

Strategically Optimised for Forex Trading Opportunities

Our trading bots are meticulously designed to identify and capitalise on diverse forex trading opportunities, prioritising strategy over speed.

They continuously scan their forex market for potential opportunities, allowing you to take advantage of favourable conditions without the stress of manual trading.

This strategic approach enhances your trading efficiency and positions you to seize forex opportunities as they arise.

Our trading bots are designed to identify and capitalise on diverse forex trading opportunities, prioritising strategy over speed without the stress of manual trading.

Emotion-Free Trading

Minimise Emotional Decision-Making

Emotion-Free Trading

Minimise Emotional Decision-Making

One of the greatest challenges and difficulties in trading is managing emotions. Fear and greed can cloud judgement and lead to impulsive decisions that may negatively impact your portfolio.

Our automated trading bots help create a structured approach to trading, significantly reducing the influence of emotions on your decisions.

While they can’t eliminate emotional factors entirely, they provide a framework for more rational decision-making, allowing you to trade with a clear mind and a focused strategy.

One of the greatest challenges and difficulties in trading is managing your emotions which can lead to impulsive decisions that may negatively impact your trading performance.

Our automated trading bots have a structured approach to trading, significantly reducing the influence of emotions on your decisions.

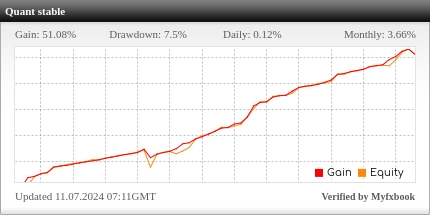

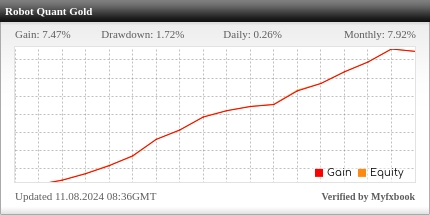

Performance Transparency

Performance Transparency

Transparency and accountability is key for us. The performance graphs below, available on Myfxbook, provide real-time analytics and metrics, enabling you to assess in full transparency their efficacy and performance dynamics.

While our trading applications have shown positive historical performance, it’s crucial to understand that past results do not guarantee future success. We encourage you to trade wisely and only what you can afford to lose.

Transparency and accountability is key so we provide via Myfxbook publicly real-time analytics and metrics on 2 of our Bots enabling you to assess their efficacy and performance dynamics.

While our trading applications have shown positive historical performance, it’s crucial to understand that past results do not guarantee future success. We encourage you to trade wisely and only what you can afford to lose.

Quant Stable

The Quant Stable trading bot is designed to trade the EUR/USD and AUD/USD currency pairs using pending orders and has a standard (changeable) risk management threshold of 20% to further manage risk.

The Quant Stable trading bot is designed to trade the EUR/USD and AUD/USD currency pairs using pending orders and has a standard risk management threshold of 20% to further manage risk.

Quant GOLD

The Quant Gold trading bot has recently been improved and specialises in trading gold without using a martingale strategy. It executes a maximum of three trades per day, with each trade having a predefined stop loss (SL) and take profit (TP) to limit potential losses. It has a standard (changeable) risk management threshold of 12% to further manage risk.

The Quant Gold trading bot specialises in trading gold without using a martingale strategy. It executes max. 3 trades per day, with a predefined stop loss and take profit. A standard risk management threshold of 12% is applied.

Are you ready to enhance your trading efficiency, minimise manual effort and reduce your emotional trading stress?

Ready to enhance your trading efficiency, minimise manual effort and reduce your emotional trading stress?

Risk Disclaimer:

Quant Trading Technology provides automated trading solutions through the algorithmic trading bots. Our services are exclusively intended for professional investors and traders. We do not offer financial advice, portfolio management, or any services requiring licensing under MiFID II or CNMV regulations.

Trading in Forex, CFDs, and other financial instruments involves substantial risks, including the potential loss of your entire investment. Leveraged products can amplify both gains and losses, and it is important to note that more than 60% of retail investor accounts lose money when trading CFDs. Only invest what you can afford to lose and ensure you fully understand the risks involved.

Our trading bots execute predefined strategies and are not tailored to individual preferences.

Past performance is not indicative of future results. Clients are fully responsible for their trading decisions and must ensure compliance with applicable legal requirements in their jurisdiction.

By using Quant Trading Technology’s services, you acknowledge and accept full responsibility for your trading activities and the associated risks.

Avenida Maisonnave 41, 03003 Alicante, Spain.

0034.623.516.321